Với mục tiêu chia sẻ kỹ thuật giao dịch price action (hành động giá, hành vi giá) mạnh mẽ nhất, hiệu quả nhất và tối giản nhất mà không cần thêm bất cứ chỉ báo kỹ thuật (indicator) nào, Naked Forex hướng dẫn nghệ thuật đọc biểu đồ, đọc hành động giá cho nhà giao dịch (trader), dù bạn có đang giao dịch trên thị trường chứng khoán, tiền tệ (forex) hay tiền thuật toán (cryptocurrency Naked Forex - Phương Pháp Price Action Tinh Gọn Naked Forex được đánh giá cao trên toàn cầu (theo Amazon) vì đã cung cấp một cẩm nang thực thụ cho những nhà giao dịch theo trường phái Price ActionEstimated Reading Time: 2 mins The price action, naked Forex. February 18, by Forex Market. When talking about trading naked (naked trading) refers to trading without the use of indicators, that is, trading based on price action without anything else. The main reason for operating without indicators is the fact that every indicator is the result of a mathematical

[Ebook Tiếng Việt] Price action – Hành động giá chuyên sâu (Tập cuối) | TraderViet

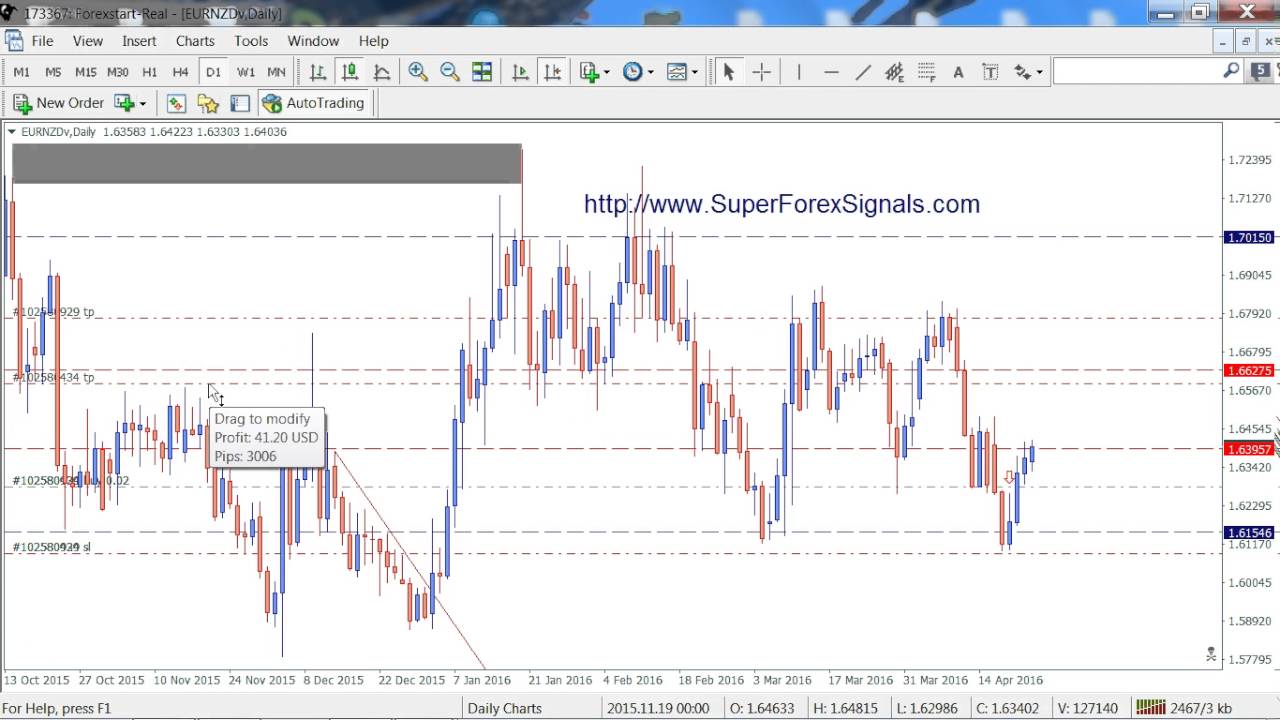

When traders refer to trading naked, they are describing a forex trading technique which does not include or require the use of technical indicators. Rather than using a technical indicator window, such as the Relative Strength Index, MACD or custom indicator codes, price action traders look within the price charts themselves to spot potentially profitable trading opportunities. Using a number of basic but skilled observations, naked forex price action, price action traders try to map the price chart in order to determine where to place their forex orders.

If the sight of too many flashy indicators and colourful lines on your charts is negatively affecting your trading, this form of naked trading january help you to become a profitable forex trader. Once of the key elements of price action trading is to be able to accurately spot areas of support and resistance on a price chart. Fortunately, these areas are often obvious however they do vary in significance. Each time that a price reaches a new high or low and retraces, for example, can be considered price naked forex price action an area of support or resistance.

This can be described as those prices on any chart where traders are looking to place orders in the opposing direction, naked forex price action. They vary in significance depending on the amount of times they have been tested and the number of times they have held up and managed to send price the other way.

Interestingly, areas of resistance often become areas of support once they are broken so the most significant of all are those which have been around for a long time acting as both on a longer term chart. Some areas of support and resistance january be several years old on a daily chart with less significant levels being observed on any hourly forex chart. Once the key areas of support and resistance have been noted on the higher timeframes, many price action forex traders drop down the time frames to look for possible entries when price nears these important zones.

Traders are looking for specific price action setups at these levels which will indicate that the area of support naked forex price action resistance has held up naked forex price action january be broken. These setups are visible on all regular forex price charts but are most clearly highlighted using the candlestick format. An example of this is when an area of support is reached on a daily chart and a clear reversal setup forms on the hourly candlestick chart.

Naked forex price action price action traders the setup is compounded by the location of price without the need for an additional indicator to confirm this and a high-probability trade can be taken from here. Trading without indicators in this way has a number of benefits. By simply plotting the known areas of support and resistance, a trader can use price action analysis to not only spot potentially high probability setups but also learn how to read the market and understand where price is likely be heading in the near future.

This is what naked trading is all about and why many forex traders are reducing their reliance on indicators to pre-empt the most reliable market moves. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how CFDs work, and whether you can afford naked forex price action take the high risk of losing your money. This website uses cookies so that we can provide you with the best user experience possible. Cookie information naked forex price action stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again. Home Introduction Broker Banking Basics Trading How to trade. Learning how to spot the key areas on a forex price chart Once of the key elements of price action trading is to be able to accurately spot areas of support and resistance on a price chart.

Spotting trading opportunities on different time frames Once the key areas of support and resistance have been noted on the higher timeframes, naked forex price action, many price action forex traders drop down the time frames to look for possible entries when price nears these important zones.

Reducing the risk of analysis paralysis Trading without indicators in this way has a number of benefits. Trade with the market leader now: eToro is one of the most popular brokers and has an excellent customers service. Related posts: Trading forex reversals Trading using recent highs and lows Accurately trading forex divergence Support and resistance trading strategies Momentum and divergence for successful Forex trading. Close GDPR Cookie Settings. Powered by GDPR Cookie Compliance.

Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings, naked forex price action. Enable or Disable Cookies. Enable All Save Settings.

1 hour Naked Forex Scalping Method

, time: 7:01Home | Naked Forex Academy

The price action, naked Forex. February 18, by Forex Market. When talking about trading naked (naked trading) refers to trading without the use of indicators, that is, trading based on price action without anything else. The main reason for operating without indicators is the fact that every indicator is the result of a mathematical Với mục tiêu chia sẻ kỹ thuật giao dịch price action (hành động giá, hành vi giá) mạnh mẽ nhất, hiệu quả nhất và tối giản nhất mà không cần thêm bất cứ chỉ báo kỹ thuật (indicator) nào, Naked Forex hướng dẫn nghệ thuật đọc biểu đồ, đọc hành động giá cho nhà giao dịch (trader), dù bạn có đang giao dịch trên thị trường chứng khoán, tiền tệ (forex) hay tiền thuật toán (cryptocurrency Naked Price Action Strategy Price action trading is the simplest and most powerful way to trade the Forex market. Check out my free basic price action strategy to learn how you can use price action to master Forex trading

No comments:

Post a Comment